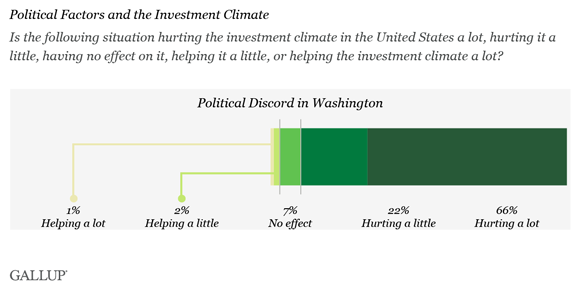

WASHINGTON, D.C. -- The biggest factor rattling investors' confidence today is the hyper-partisan atmosphere in the nation's capital. Two-thirds of U.S. investors say political discord in Washington is hurting the U.S. investment climate a lot, eclipsing investors' level of worry about eight other issues.

These results are from the most recent Wells Fargo/Gallup Investor and Retirement Optimism Index, conducted Aug. 15-24 with 1,011 investors, including 374 retirees and 631 nonretirees. The index is a measure of broad economic and financial optimism among U.S. investors with $10,000 or more in any combination of stocks, bonds, mutual funds, self-directed IRAs, and 401(k) retirement accounts. This index was up in the third quarter, but is still far below pre-recession levels.

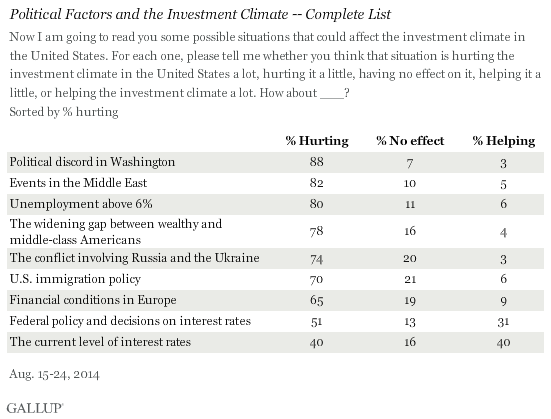

Political discord, income inequality, and tensions in the Middle East top a list of nine issues that Gallup asked about as part of the Wells Fargo/Gallup Investor and Retirement Optimism Index. Investors considered most of the factors asked about as harmful to the investment climate, except the current level of interest rates. Investors were evenly split in their views on whether the current level of interest rates is helping or hurting the situation for investors. The Federal Reserve has been consistently keeping interest rates low since the advent of the Great Recession.

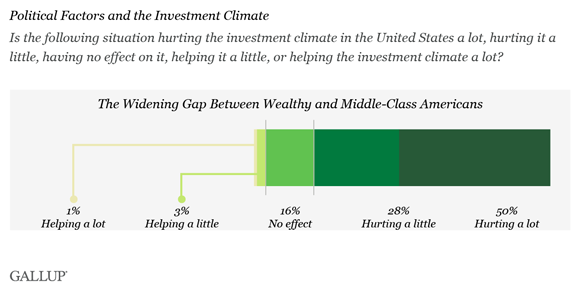

Income Inequality Cited as Hurting Investment Climate in U.S.

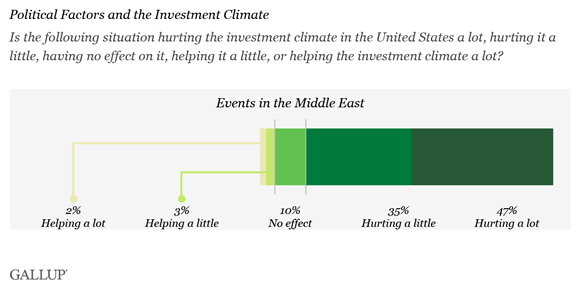

Roughly half of investors mentioned the widening wealth gap in the U.S. or events in the Middle East as hurting the investment climate a lot. This survey was conducted as tensions between Israel and Hamas flared, which may have elevated investors' anxiety about the stability of the global market. Political and economic developments such as these potentially explain why U.S. investors continue to express concern about the stock market, even as it continues to hover at historic highs.

President Barack Obama has made income inequality a hallmark of his second-term agenda amid reports from the U.S. Census Bureau that the income gap between the richest and the poorest grew to its widest in 2011. Investors may be taking note of an increased governmental focus on this issue, as 78% said the widening gap between wealthy and middle-class Americans is hurting the investment climate at least a little, including 50% who say it is hurting American investing a lot. There is a small divide between investors with particular amounts invested in the market: 46% with more than $100,000 in investments say the income divide is hurting American investing a lot, while 55% of those with less than $100,000 in investments say the same thing.

Middle East Tensions Having Significant Impact on Investors' Views

Increased tensions in the Middle East -- especially the conflict between the Israelis and Hamas -- have been a prominent issue in 2014. This boiling cauldron of pressures has likely affected investors' views of the investment climate in the U.S. Forty-seven percent say events in the Middle East are hurting the climate a lot, while 35% say these events are hurting a little. Ten percent say they are having no effect.

Aside from broad-based concerns with warring factions in the Middle East, investors may be concerned about oil production fluctuation and the economic vitality of the region.

Bottom Line

Political discord is a top factor harming American investors' views of the current investment climate. It is clear that investors are paying attention to events in the U.S and abroad and these developments are having an impact on their views about investing.

While the discord in Washington is not a new phenomenon, it gained special prominence during the 2012 election when both Republican candidate Mitt Romney and President Obama highlighted how the contentious environment in government might be problematic for small businesses.

Perhaps surprisingly, 75% of those with $100,000 or more invested in the market say that income inequality is hurting the investment climate to some degree. With a Congressional Budget Office report stating that between 1979 and 2007 household income of the top 1% of earners grew by 275%, compared with 65% for the next 20%, less than 40% for the next 60%, and 18% for the 20% of the population with the lowest income, the new Gallup survey results suggest that wealthier investors might be bothered by the growing gap between wealthy and middle-class Americans.

Overall, these concerns may help explain investors' continued reluctance to view the stock market as a good place to invest. This is despite the market mostly holding steady in the upper 16,000 or low 17,000s all year.

Survey Methods

Results for this Wells Fargo/Gallup Investor and Retirement Index survey are based on questions asked Aug. 15-24, 2014, on the Gallup Daily tracking survey, with a random sample of 1,011 adults, having investable assets of $10,000 or more.

For results based on the entire sample of investors, the margin of sampling error is ±3 percentage points at the 95% confidence level.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

For more details on Gallup's polling methodology, visit www.gallup.com.